Four Basic Retirement Planning Questions

How long do you expect to live?

First, the good news. Studies have shown that retirees and near retirees are actually quite good at predicting their own expected remaining years of life (see, for example, "Perception of Mortality Risk: Implications for Annuities" by Drinkwater and Sondergeld). Further evidence of this is provided by the life insurance industry, which has found that people purchasing annuities (who derive maximum benefit only if they live for a long time) actually live longer than what standard mortality tables would predict.

The bad news, however, is that the chance you will outlive your savings, and suffer a sharp drop in your standard of living (known as "longevity" or "mortality" risk) usually gets less attention from retirees than concerns about their health and their investment returns.

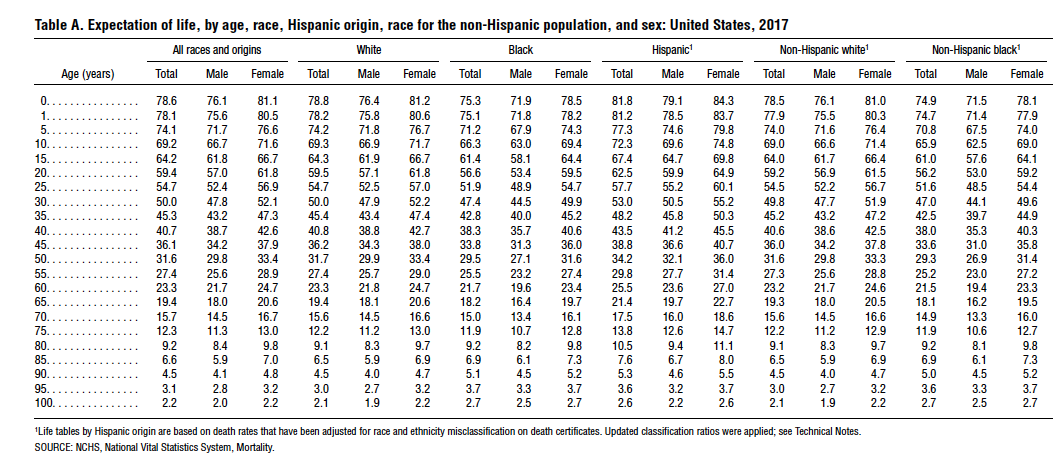

One way to assess this risk is to look at standard remaining years of life tables, like the following one that comes from the US Social Security Administration, which shows estimated remaining years of life at different ages. Unfortunately, tables like this only show the "most likely" remaining life expectancy; in practice, there many outcomes on either side of this estimate (though there are some life expectancy calculators available that claim to provide more accurate estimates after you enter health and lifestyle data).

Given this, there is no way to escape the need to make a trade-off when dealing with what is technically called"longevity risk (or, more practically, "outliving your savings"). There are four ways to manage this risk, as we will discuss in the next section, "should you annuitize your savings?"